Seismic operations complete, Lofin-2 gas well test commences, H2 project progresses

Lion Energy Limited (“Lion” or “Company”) is pleased to report substantial progress in Q4 2022 in both oil & gas and hydrogen.

Highlights include:

- Green hydrogen strategy further refined and announced.

- Electrolyser and refuelling equipment vendors selection finalised.

- Hydrogen project location selection nearing completion.

- Seismic operations on the exciting East Seram Survey completed post quarter end in January 2023 with a total of 194 km line kilometres

recorded. - Challenging seismic survey conducted safely, with over 918,729-man hours exposure to quarter end without lost time incident.

- Processing of the seismic data commenced in November with results expected in Q2 2023.

- The Testing Program at the key Lofin-2 gas well in the 1.5TCF Lofin gas field commenced during the quarter.

- Cash at quarter-end was US$6.0 million (excluding joint-venture cash), compared to US$6.4 million at the end of Q3 2022.

- Seram (Non-Bula) PSC production for the quarter was 115,874 bbls (Lion’s share 2,897 bbls).

- A crude oil lifting of 224,853 bbls was completed in the quarter, with Lion’s net revenue share on a pre-tax basis being US$321,699.

Mr Soulsby, Lion’s Chairman, commented “It was a busy quarter in oil and gas, with most of the work on our East Seram onshore seismic survey completed. The recording of the survey was actually finished in January 2023. This is a major milestone for the company. Importantly, there have been no lost time incidents to date and the survey has been completed within 10% of budget. This is an outstanding achievement given the challenging remote location and is testament to our operational personnel and the contractors involved with the survey. We now look forward to the processing and interpretation of the data over some highly material structures with results expected in Q2 2023. We continue to have good production from the Oseil field and re-entry and testing of the Lofin-2 well commenced December 18 and is expected to complete during this 1st calendar quarter. The test is a crucial path for the commercialisation of the 1.5TCF gas field, one of Indonesia’s largest onshore discoveries in the last 20 years.”

“Concurrently, we continue our progress to position Lion at the forefront of hydrogen production and refuelling in Australia at a time when zero emissions are becoming more and more important for Federal and State Governments. Significantly, our work with Wasco, and our increased engineering capacity, enabled us to conclude FEED and our priority now is finalizing the first location selection. We selected vendors and updated our hydrogen focus during the Quarter and remain resolved to build our first hydrogen production and refuelling station in 2023.”

Green Hydrogen Update

In the previous quarters, Lion outlined the reasoning for the Company’s focus on heavy mobility and in particular, public transport bus operators. Lion is now moving to establish key refueling infrastructure for Fuel Cell Electric Buses (FCEB) and on 25 May 2022 appointed Wasco to conduct front end engineering and design (FEED) for the Company’s first hydrogen production and refuelling station in Australia. Lion reported the highlights of the FEED in the last quarterly report and is now actively finalizing the selection of its first location, with commercial negotiations and related due diligence close to finalization.

During the Quarter, Lion selected major equipment vendors and is working to ensure compliance with Australian standards. In parallel, Lion initiated the approval process required install and operate the hydrogen production and dispensing infrastructure, with project completion aimed for H2 2023. Lion’s plan is to produce the hydrogen via electrolysis at a production hub. The hydrogen will then be compressed to 200 Bar and loaded on tube trailers. The tubes will be unloaded at refuelling stations, where hydrogen is further compressed to 450 Bar to be stored or directly delivered to vehicles via onsite refueller. This is a well-established model in other countries with no technology risk and excellent safety records.

Lion outlined its updated green hydrogen strategy in the Quarter and highlighted:

- The establishment of a first class best in-country execution team

- Goal for first hub by end 2023

- AUD$12m capex per unit (production and refuelling)

- 20 hydrogen locations by end 2026

- H2 pricing at parity with diesel

Lion is in active discussions with multiple parties to enter into a joint-venture arrangement for its hydrogen project. Figure 1 below is the latest hydrogen hub project concept design image post FEED.

Figure 1 – Advanced Hub Concept Model Post FEED

Roadmap

As part of recent announcements, Lion presented the following provisional roadmap and has responded to the objectives as listed in Table 1, in the quarter under review.

Table 1 – Lion’s provisional green hydrogen roadmap vs response (as at end December 2022)

| Stated Objective | Response |

|---|---|

| Stage 1 | |

| Publish broad green hydrogen strategy | Completed |

| Register business name | Completed |

| Stage 2 | |

| Establish team of hydrogen experts | Completed |

| Appoint experts to systematically analyse optimal electrolyser locations in Australia | Completed |

| Review the best value and fit for purpose solar, wind and electrolyser technologies | GPA phase 2 work completed, appointed Armana Energy as special advisors |

| The review of opportunities in which Lion maybe able to combine its expertise and resources with suitable market and partner to progress a green hydrogen development using identified electrolyser location and appropriate technologies | Partnerships expanded : Wagners, Chenstar, H2 Technology, Foton Mobility, BLK Auto and Pulitano Group. Lion is working with public transport authorities and bus fleet operators in NSW, Vic and NSW |

| Expand the scope of the Advisory Board to review opportunities in H2 distribution and hydrogen fuel cells for heavy equipment and vehicles | Advisory board have an ongoing role and involvement in the work being undertaken by Wasco, Armana including reviewing submissions by Chenstar and other equipment providers |

| Stage 3 | |

| Appoint consultants to undertake a feasibility study to as certain the economic viability of a short listed opportunity and the anticipated cost | FEED completed, work in progress |

| Secure any required land rights conditional upon Lion proceeding with an opportunity | Work in Progress |

| Investigate investing in a pilot or demonstration plant including H2 distribution and Hydrogen fuel cell heavy equipment and vehicles | Submissions made back to base fleet businesses |

| Stage 4 | |

| Subject to a positive feasibility study, progress the opportunity by participating in the development of a smaller or larger solar/wind farm and relevant energy storage facilities to produce green hydrogen at low cost for domestic or export markets | Conditional upon stage 3 work being completed |

| Form a joint venture with a suitably experienced and funded partner | Working up proposal with counterparties |

Oil and Gas Operations update

East Seram PSC

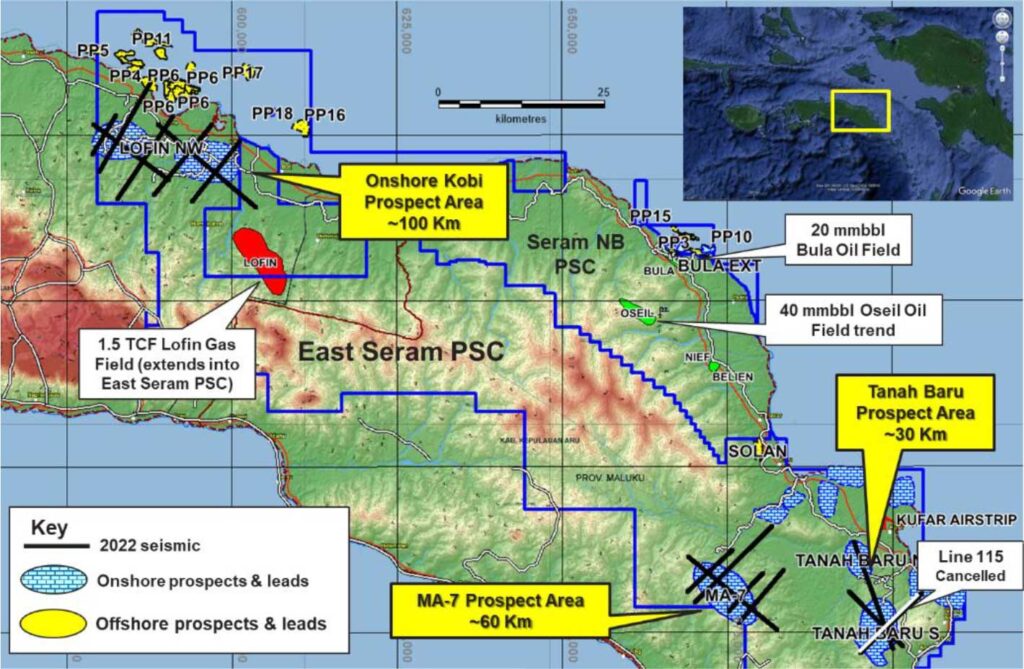

Figure 2 – East Seram PSC location map showing 2022 seismic survey

During Q4 2022 Lion made solid progress with our exciting onshore seismic program in East Seram. Shot hole drilling production continued to improve despite challenging conditions with additional drilling crews mobilised to the island. Recording of seismic data commenced in the northwest onshore Kobi area on 28 October and was completed in this area in early December. When operations moved to the more challenging Tanah Baru and MA-7 Prospect areas in the southeast of the East Seram block, a second helicopter was mobilised in late November.

Operations proceeded well with the seismic recording in the southeast area and the recording activities for the entire survey completed post-quarter end in January 2023. The complementary Gravity survey acquisition (1000 stations) was completed on 7 December. Lion’s Exploration Manager, Kim Morrison, and Seismic Operations Manager, Alan Fenwick, visited the survey operations in early November.

Due to an issue with land access approval in an isolated area in the Tanah Baru prospect, a decision was made by Lion management in late December not to record one of the seismic lines (line 115). This decision was supported by the Indonesian regulator SKK Migas. Lion is however confident that there remains sufficient data to mature the Tanah Baru prospect. In addition to the two new lines (lines 116 and 117) and the new Gravity Data acquired, there is existing 2008 vintage seismic to aid the interpretation. In total approximately 194 km of line data was recorded during the survey which includes 14 km of recorded line tails without shot holes.

The survey continues to be conducted safely with a strong emphasis on HSE with a total of 918,729 man-hours spent on the survey by Quarter end with no loss time incidents (LTI). The survey is designed to mature the high-graded prospects and leads of the exciting Seram fold-belt play. The play has the Jurassic age Manusela Formation fractured carbonate reservoir objective and is already proven with the oil producing Oseil Oil Field and the 1.5 tcf Lofin Gas Field. A combined, unrisked, P50 (Best estimate) prospective resource1 of 675 mmboe is calculated for the 5 key targeted leads (MA-7, Tanah Baru North, Tanah Baru South, MA-10 and MA-11). The largest lead, MA-7, has an oil prospective resource1 of Low (P90) 39 mmbbl, Best (P50) 190 mmbbl, and High (P10) 881 mmbbl and a chance of success currently estimated at 24% (refer Lion ASX release dated 4 March 2019).

The final cost of the onshore seismic program, including processing and interpretation, will be within 10% of the initial estimated cost of USD7.2mm. This is an excellent result for Lion given the remote, challenging area explored. The survey was approximately 80% funded by Lion’s partner, OESC under previously announced farm-in arrangements (refer Lion ASX release dated 26 September 2019). Lion, via its wholly owned subsidiary Balam Energy Pte Ltd, holds a 60% participating interest in the East Seram PSC, located on and offshore east Seram Island in Eastern Indonesia.

Figure 3 – Recording of seismic shots NW Kobi area being observed by Lion’s Seismic Operation Manager (Alan Fenwick) and Exploration Manager (Kim Morrison)

Prospective Resources are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from undiscovered accumulations by application of future development projects. Prospective Resources have both an associated chance of geologic discovery and a chance of development. Prospective Resources are further categorized in accordance with the range of uncertainty associated with recoverable estimates, assuming discovery and development, and may be sub-classified based on project maturity. Further exploration, appraisal and evaluation is required to determine the existence of a significant quantity of potentially moveable hydrocarbons.

Seram (Non-Bula) PSC

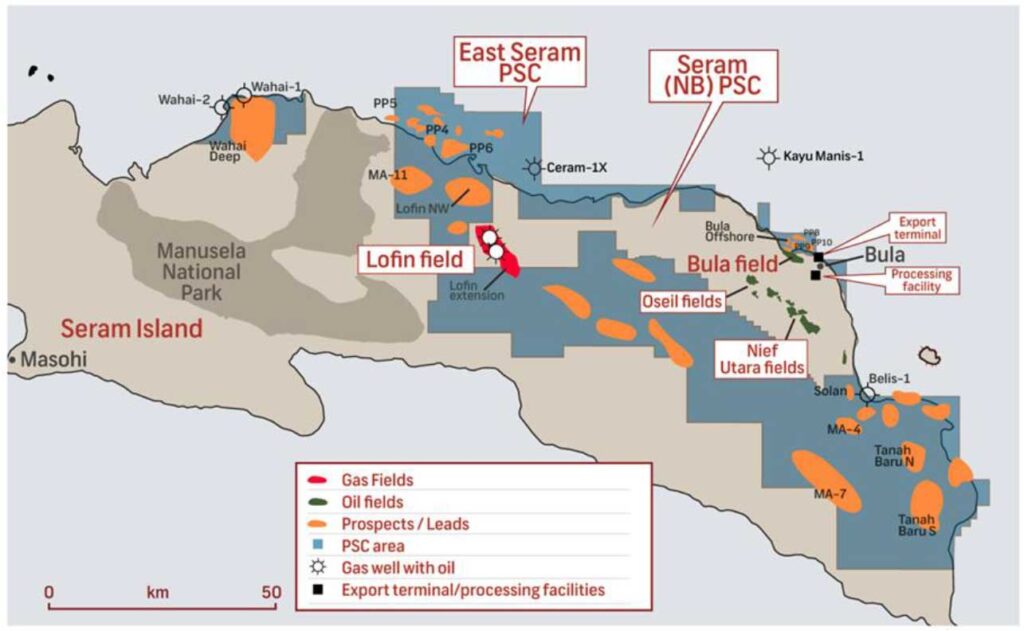

Figure 3 – Seram (Non-Bula) Block PSC location map

Lion, via its wholly owned subsidiary Lion International Investment Ltd, holds a 2.5% participating interest in the Seram (Non-Bula) PSC (“SNB PSC”), located onshore Seram Island in eastern Indonesia. The block contains the Oseil oil field and surrounding structures that have yielded cumulative crude oil production of 19,739,117 barrels since production started in January 2003 through to 31 December 2022.

As previously reported by Lion, in 2015, the Lofin-2 appraisal well confirmed a highly material gas discovery in the SNB PSC. The Lofin Gas Field has Contingent Resources (2C) of 1450 bcf (100%), Lion share 36.3 bcf. Re-entry and testing of the Lofin-2 well commenced on 18 December 2022, with re-entry, testing and completion of the well in readiness for commercialisation, expected to complete during Q1 2023.

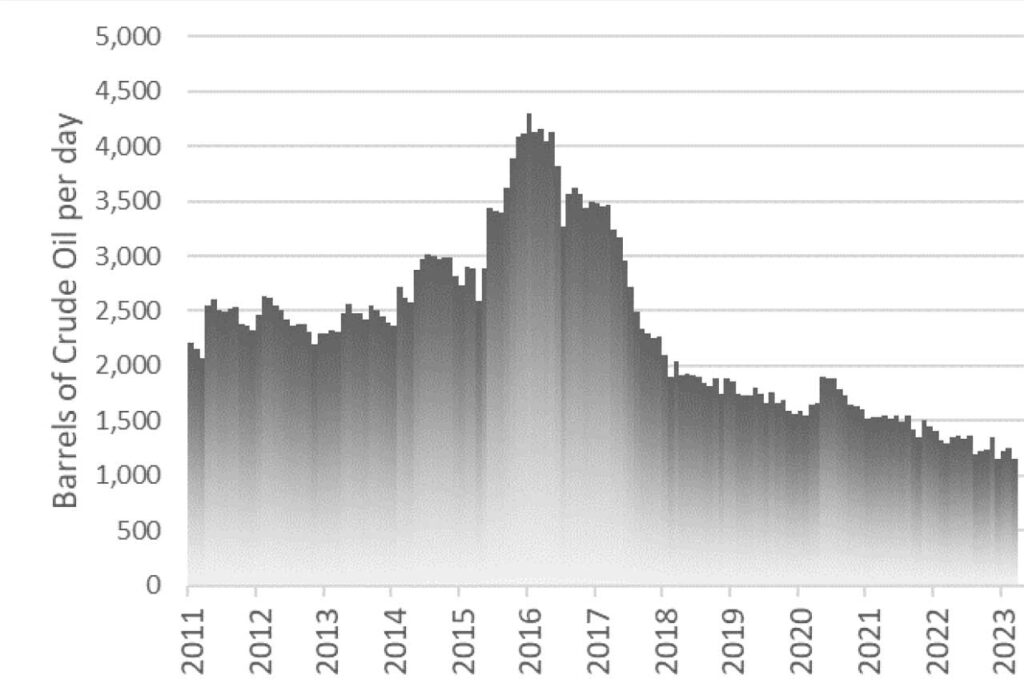

Chart 1 – Seram (NB) Block – daily production per calendar month (bopd)

Progress to 31 December 2022 included the re-entry part of the well test, including drilling out three cement plugs in readiness to drill out the final cement plug sitting above the open hole Manusela Formation reservoir. The primary objective of this well test is to isolate the water zone and determine hydrocarbon fluid characteristics of the Manusela limestone formation to enable the Joint Venture to move forward with commercialisation options currently under review. The company will provide ongoing updates on progress of the Lofin-2 well test.

Production

During the quarter, gross crude oil production from Oseil and surrounding oilfields was 115,874 bbls (Lion’s gross share 2,897 bbls). Daily production averaged 1,259 bopd (Lion’s interest being 31 bopd). A crude oil lifting of 224,853 bbls was completed on 28 December 2022, at USD63.065/bbl, with the Government Share 9.2550%. Proceeds net to Lion pre-tax was USD321,699. Following the lifting, crude oil available for lifting as of 31 December 2022 was only 5,170 bbls.

A well service was performed on Oseil-29 to replace the downhole electric submersible pump (ESP). The well was returned to production on 25 December 2022. Operating costs were steady at US$24.3 per barrel for the Quarter, with an operating cost of US$23.6 for the 2022 calendar year.

Regulatory update

In January 2021, CITIC Seram, the operator of the Seram (Non-Bula) PSC, was requested by the Government of Indonesia, in accordance with the terms of the PSC, to offer a 10% participating interest to a RegionalOwned Company appointed by the local Government of Maluku. The 10% would be transferred by the existing participants in the PSC pro-rata to their respective participating interests.

In March 2021, CITIC Seram received a first Letter of Intent from the Regional-Owned Company requesting to start a due diligence process. In January 2022, the Regional-Owned Company advised that it had completed its due-diligence and intends to acquire the 10% participating interest subject to commercial terms to be agreed. Based on a letter issued by the Minister of Energy and Mineral Resources in the Republic of Indonesia, the price for the 10% participating interest will be 10% of the performance bond provided by the PSC at the time of the PSC extension in 2019. The process remains unresolved and is expected to complete in this next Quarter. At completion, Lion’s participating interest in the Seram (Non-Bula) PSC will reduce to 2.25% from 2.5% currently.

Corporate

The Company continues to maintain a focus on costs, whilst pursuing activities in Indonesia and in green hydrogen in Australia. Lion expects G&A costs to track steady year on year below US$1m.

Related Party Payments

During the quarter, the Company made payments of US$243,000 to related parties and their associates. These payments relate to the existing remuneration agreements for the Executive and Non-Executive Directors.

Summary of petroleum tenements held as of 31 December 2022

[table “7” not found /]

ENDS

This ASX announcement was approved and authorised for release by the Board of Directors.

Qualified petroleum reserves and resources evaluator requirements

In accordance with ASX Listing Rule 5.43 the Company confirms that references to petroleum reserves, contingent resources and prospective resources have previously been announced (7/9/2018, 10/9/2018, 04/03/2019, 13/04/2021 and 16/06/2021). The Company confirms that it is not aware of any new information or data that materially affects the information included in this announcement and that all the material assumptions and technical parameters underpinning the estimates in this announcement continue to apply and have not materially changed.

Glossary

| bbl: barrels | JV: joint venture | PSC: Production Sharing Contract |

| bcf: billion cubic feet | KB: Kelly bushing | psi: pounds per square inch |

| bopd: barrels oil per day | mmscfgd: million standard cubic feet of gas / day | tcf: trillion cubic feet |

| BOP: blow out preventer | mmbbl: million barrels | Sq.km: square kilometres |

| ESP: Electric submersible pump | mmboe: million barrels oil equivalent | ss TVD: sub-sea true vertical depth |

| FTP: first tranche petroleum | MD: measured depth | TD: total depth |